What is False Identity Fraud?

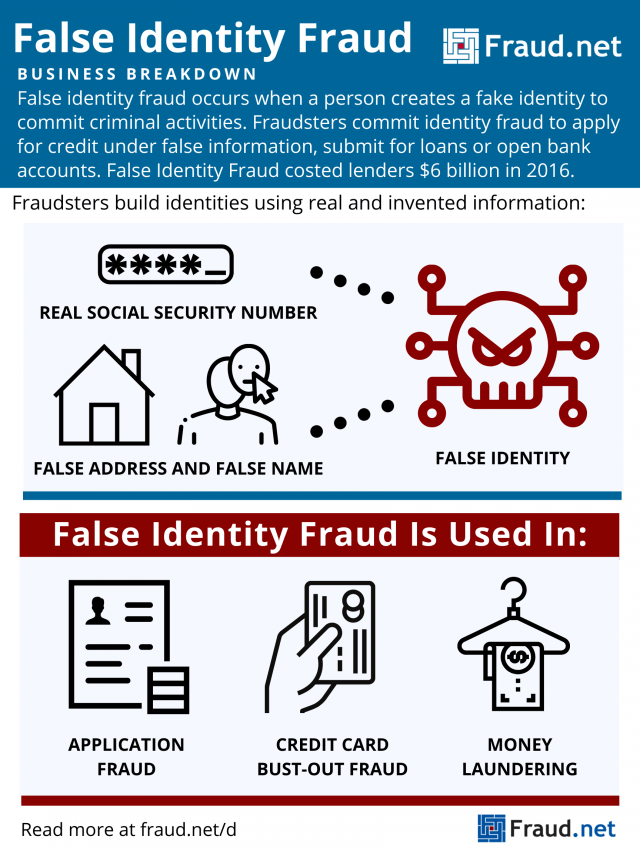

False identity fraud occurs when a person creates a fake identity to commit criminal activities. Fraudsters commit identity fraud to apply for credit under false information, submit for loans or open bank accounts.

Fraudsters obtain the information they need to construct a false identity through identity theft methods like phishing, credit card fraud, and obtaining fullz. Once they have this information, they invent some of their own rather than impersonating a living person.

For example, they may combine an existing social security number with a falsified address and name. This results in a synthetic identity they then use to commit fraud. Additionally, they may engage in social engineering to make false identities seem more legitimate, to avoid detection.

Children’s SSNs are more likely to be selected for synthetic identity fraud, as they offer a blank slate for fraudsters to build their identity upon. Additionally, false identities can be harder to discover with childrens’ SSNs, as their financial history is rarely paid attention to until the child grows older. Unfortunately, children’s identity information is often easier to obtain due to their vulnerability to phishing and other online scams.

How Do Fraudsters Use False Identities?

Fraudsters use false identities to commit a variety of fraudulent and criminal actions. They include:

- Application Fraud – Fraudsters use the good reputation (or blank slate) of an identity to apply for loans or credit cards. Then, they disappear once it comes time to pay back the loan or credit debt. An application for a credit card, even if rejected, can serve to legitimize a false identity. Afterward, a fraudster can use that legitimated identity to apply for loans and credit cards more easily.

- Credit Bust-Out Fraud – Fraudsters open new credit accounts with falsified information and establish a normal usage pattern over several months or years. Suddenly, they max out all cards with no intention of paying back the debt. Then, they repeat the process.

- Money Laundering – Criminals use false identities to engage in the trafficking of people, money, and drugs. The use of false identities allows them to avoid government detection.

- Fraud Rings – Fraudsters manage thousands of fake accounts with falsified data to commit fraud simultaneously. In these, they employ methods like bust-outs or application fraud at a large scale.

The Cost to Businesses

False identity fraud accounted for about USD $6 billion in costs to lenders in 2016 and 20% of all credit losses for financial institutions that same year – and the number is only increasing. Aite Group discovered losses of USD $820 million to synthetic identity fraud in 2018. They project that number to increase to about USD $1.25 billion over the next two years.

However, the Federal Reserve presumes that the number could be much larger, due to particular fraud detection oversights, such as lack of investigation, lack of consistency in which attributes to assess, lack of awareness, and lack of reporting.

Fraud.net has a Solution

While attempting false identity fraud is considered a felony in most jurisdictions, the volume of attacks prompts organizations to prevent false identity fraud rather than prosecute it. They do so through methods of identity verification and rules-based screening. Additionally, they may do risk-scoring to approve or deny transactions based on how high of a potential fraud risk they are.

Artificial intelligence, data mining, and machine learning provide an edge to false identity fraud protection. Institutions protect their consumers better by stopping crime in its tracks rather than reacting after the fact.

Fraud.net combines AI & deep learning, collective intelligence, rules-based decision engines, and streaming analytics to detect fraud in real-time, at scale. To learn more about the solutions we offer to stop fraud before it affects your business, click “talk to a fraud expert” below.