+$150 Billion

recently legalized by regulators

+$5.8 Billion

of fees available to sports betting sites

32

online sports betting within 5 years

Gaming

The Epic Online vs Offline Battle

Reputation and Fraud Avoidance

The Challenge

Online gaming and gambling companies encounter unique challenges with their users who seek to unfairly take advantage of the system for personal gain. Collusive play and bonus abuse are the most common and are often the manifestations of organized rings conducting deposit fraud and/or money laundering. Millions of fraudulent users in the US are applying to, and transacting with, online betting sites every month.

The Solution

Continuous monitoring, passive and active authentication, anomaly detection and artificial intelligence combine to make a potent antidote to identifying the bad players on your gaming site.

Products to Ensure Trust and Beat Fraud

at Every Step of the Customer Lifecycle

Choose one or combine them for even stronger protection.

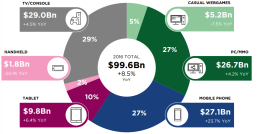

Online Games - Growth & Monetization

As in most other industries, the global games market (across PC/MMOGs, consoles, and all other media) has grown significantly and is shifting towards a mobile experience. Combined with new means of monetization and the use of alternative payments methods, fraud is quickly emerging as a primary concern, having the ability to simultaneously shock the developer’s cash flow and damage reputation.

Early Adopters Will Win Big

As computer processing power has increased, so has the ability to analyze large data sets. It is now possible to successfully analyze billions of transactions, account openings and other financial events, in real time and at scale. Fraud.net’s AI team specializes in techniques known as ‘deep learning’ as artificial neural networks have many layers of simulated interconnected neurons. Early AI adopters have higher sales growth and profit margins — and the performance gap with the laggards is expected to widen further.