Chargeback Protection for Merchants

20%

43%

$3.48

Chargebacks are the symptom of an anti-fraud program that can be improved. While some chargebacks are submitted with legitimate transaction problems with supply or delivery, most estimates put some form of fraud as the primary driver of 80% of all chargebacks. This is where chargeback protection for merchants comes in.

Reduce your chargeback rates and prevent chargebacks by leveraging our cross-industry dataset of a billion transactions, advanced analytics, and AI and deep learning enhancements.

Products to Ensure Trust and Beat Fraud

at Every Step of the Customer Lifecycle

Choose one or combine them for even stronger protection.

Gradually, then Suddenly

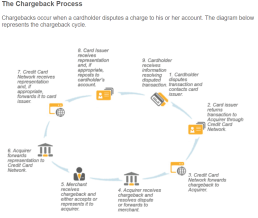

As illustrated to the right, chargebacks occur when a cardholder disputes a charge to his or her account, and experts estimate that as much as 80% of the number of chargebacks that arise involve fraud. The chargeback process is as follows:

- cardholder disputes transaction and contacts credit card issuing bank,

- issuing bank returns the transaction to the acquiring bank through the credit card network,

- credit card network forwards the chargeback to the acquiring bank,

- acquiring bank receives chargeback and resolves the transaction dispute or forwards it to the merchant,

- merchant account receives the chargeback and either accepts it or submits documentation to the acquiring bank in its defense,

- acquiring bank forwards the defense to the credit card network,

- credit card network receives the documents and forwards them to the issuing bank,

- issuing bank receives documentation and releases funds to the cardholder’s account,

- the cardholder receives funds and/or information resolving the disputed transaction.

With only 14% of cardholders contacting the digital merchant before filing a chargeback, and with payment processors and card networks having an increasingly low tolerance for chargebacks before imposing fines and holding back reserves, allowing chargebacks to grow represents one of the few existential threats for a digital merchant.

With Fraud.net’s chargeback protection for merchants, you will be able to monitor all of the points during a customer and transaction lifecycle that, left unmanaged, cause potential high risk for chargebacks. Machine learning and anomaly detection will help extend good controls, continuous monitoring, and advanced analytics. Learn how to better protect your business today with fraud protection solutions.

The Network Effect

Broad-based attacks, schemes and strategies can be most effectively countered with a unified, technology-based defense adopted by all the potential targets – a massive cross-industry, cross-border collaboration at a scale that businesses (and fraudsters) have not yet experienced.