Application Fraud

> 10%

49%

51%

Application Fraud, in which the applicant deliberately fabricates or falsifies information to increase the likelihood of having his or her application accepted, is on the rise and is especially harmful to financial institutions and credit-granting organizations. Often this includes the use of manipulated or stolen personal and financial data, pay slips, bank statements, and other source documents.

Early identification is key and is made possible using device and behavioral fingerprinting, anomaly detection, network analyses and machine learning algorithms.

Products to Ensure Trust and Beat Fraud

at Every Step of the Customer Lifecycle

Choose one or combine them for even stronger protection.

An Ounce of Prevention...

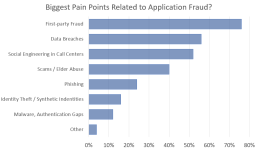

Approximately 60% of application fraud is ‘first-party’ fraud, where the fraudster is the customer. This occurs more often when loan applications are approved and funded same day. Even if funding happens after a longer period of time, first-party application fraud occurs on average with a more than double the losses (bust-out fraud). First-party fraud accounts for 5%-20% of bad debt at a typical enterprise lender, and the fraud problem cannot be solved using credit risk methods.

Instead, immediate and sophisticated data analysis and scoring must be completed using machine learning to remove the fraudulent activity upon application.

Stop Fraud, Not Customers

Machine learning, anomaly detection, geolocation and behavioral analyses can all be combined to detect high-risk sessions on your site and prevent most fraudulent logins. Banks, crypto exchanges and other organizations with fiduciary duties are especially vulnerable, but also have the opportunity to set themselves apart as a high-trust partner with their consumers.